| Home | Open Account | Help | 361 users online |

|

Member Login

Discussion

Media SharingHostingLibrarySite Info |

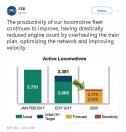

Eastern Railroad Discussion > CSX's graphic on locomotive reductionsDate: 04/24/18 19:17 CSX's graphic on locomotive reductions Author: inCHI I don't recall seeing this graphic, posted on March 1st by CSX on twitter, being posted here. In any case, I missed it then. I understand how fewer locomotives are part of the "precision scheduled" plan at CSX, and that is aided by the loss of traffic. Nevertheless it is still striking to see these numbers are so opposite of the other Class One's. From what is posted on here, it seems like:

UP: Deep storage lines are now almost all back in service BNSF: Many stored engines are back in service NS: Extra engines are being leased CN: Locomotives on order, extra engines are being leased CP: (not sure) CSX: Massive locomotive reductions.  Date: 04/24/18 20:39 Re: CSX's graphic on locomotive reductions Author: illini73 That is an interesting chart. The CSX strategy of making more money hauling less tonnage and, more importantly, using fewer assets, seems to be working. It's a "stop investing, constrain capacity and raise prices" approach which improves return on assets, making investors happy. Of course, it also limits long-term growth, which (eventually) makes investors unhappy.

CSX's chief competitor was (until they got the daylights scared out of them by the CP takeover proposal) following the "make more money by hauling more traffic" strategy. What NS's approach is now, I'm not sure. I know the RR stock analysts were disappointed that cloning technology hadn't advanced sufficiently to allow Hunter Harrison to work at all six of the major roads. But the actions of CN's new (interim) CEO are indicative of the fact that "Precision Railroading" is not really a viable long-term strategy unless you don't care about survival. Date: 04/25/18 02:17 Re: CSX's graphic on locomotive reductions Author: JPB inCHI Wrote:

------------------------------------------------------- > I don't recall seeing this graphic, posted on > March 1st by CSX on twitter, being posted here. In > any case, I missed it then. I understand how fewer > locomotives are part of the "precision scheduled" > plan at CSX, and that is aided by the loss of > traffic. Nevertheless it is still striking to see > these numbers are so opposite of the other Class > One's. From what is posted on here, it seems > like: > > UP: Deep storage lines are now almost all back in > service > BNSF: Many stored engines are back in service > NS: Extra engines are being leased > CN: Locomotives on order, extra engines are being > leased > CP: (not sure) > CSX: Massive locomotive reductions. Related to this trend is the Cl 1 hiring plans for train (taken from WSJ article re: signing bonuses of new RR hires), engine and yard, or TE&Y, workers: - BNSF plans to hire 2,000 - UP needs 2,100 more - NS plans to hire 1,400 conductors - CSX plans on no new hires (CSX still operates with more employees per the amount of volume it moves than its peers) IMO, CSX's major reductions in both locomotives and operating personnel perhaps assume pending major CSX line sales, which have been alluded to a few months back. Edited 1 time(s). Last edit at 04/25/18 02:18 by JPB. Date: 04/25/18 02:48 Re: CSX's graphic on locomotive reductions Author: Partial_List illini73 Wrote:

------------------------------------------------------- > That is an interesting chart. The CSX strategy of > making more money hauling less tonnage and, more > importantly, using fewer assets, seems to be > working. When a company manipulates numbers with their own set of unique metrics then they make anything look like it is working. Matt Posted from iPhone Date: 04/25/18 06:07 Re: CSX's graphic on locomotive reductions Author: deestrains If you look at NS's 1Q results just posted, you will see they added 70k domestic intermodal units YoY vs. flat on CSX. Also NS's rev. per unit spiked as well. The hypothesis is that all of the time-sensitive stuff that could leave CSX left in 4Q/1Q and went to NS.

Date: 04/25/18 06:08 Re: CSX's graphic on locomotive reductions Author: dreese_us When you plan on growing revenue by cutting costs(headcount reductions and elimination of equipment) you get to the point there is no more to cut. You will also be in no position to grow or handle surges in traffic. The options left are sell or merge with another company.

Posted from iPhone Date: 04/25/18 06:31 Re: CSX's graphic on locomotive reductions Author: gandydancer4 With all this new data that is being presented, along with what we already know about CSX, it would appear that they are putting themselves in an excellent position to be merged or taken over. We will see.

Date: 04/25/18 09:47 Re: CSX's graphic on locomotive reductions Author: bath_wildcat gandydancer4 Wrote:

------------------------------------------------------- > With all this new data that is being presented, > along with what we already know about CSX, it > would appear that they are putting themselves in > an excellent position to be merged or taken over. > We will see. Just like that bafoon EHH wanted it to be. Proven right yet again. "Those who forget the past are condemned to repeat it." As once said by a gerbil from Joe Cartoon. Seems that some of you didnt look into EHH past and how SCREWED UP Precision Railroading really is! Michael Fair Royal Oak, MI Date: 04/25/18 10:16 Re: CSX's graphic on locomotive reductions Author: bradleymckay gandydancer4 Wrote:

------------------------------------------------------- > With all this new data that is being presented, > along with what we already know about CSX, it > would appear that they are putting themselves in > an excellent position to be merged or taken over. > We will see. That's what I think too. CSX stock price would skyrocket if one is announced. My guess is either BNSF or CP. I don't think UP wants anything to do with CSX as it is right now. Allen Date: 04/25/18 10:35 Re: CSX's graphic on locomotive reductions Author: Realist The accepted wisdom in today's cost-conscious railroads

is that if you are not holding a few trains for power, you have too many locomotives and are therefore wasting money. I always wonder how that plays with the customers whose cars are on the trains that are being held for power. Date: 04/25/18 12:09 Re: CSX's graphic on locomotive reductions Author: MP403 deestrains Wrote:

------------------------------------------------------- > If you look at NS's 1Q results just posted, you > will see they added 70k domestic intermodal units > YoY vs. flat on CSX. Also NS's rev. per unit > spiked as well. The hypothesis is that all of the > time-sensitive stuff that could leave CSX left in > 4Q/1Q and went to NS. Actually, CSX's intermodal figures suffer from comparison to last year, when it was still using a hub-and-spoke strategy for low-volume intermodal lanes. This business was not profitable enough, so CSX got rid of it. This traffic between low-volume terminals, which was sorted at North Baltimore, Ohio, accounted for 7 percent of the railroad's intermodal traffic. So flat traffic for the first quarter of this year would translate into 7-percentish growth if you took the loss of low-volume traffic into account. I'm not saying whether CSX's decision was right or wrong. But when comparing numbers it's always best to do apples vs. apples. Date: 04/25/18 15:16 Re: CSX's graphic on locomotive reductions Author: ns1000 gandydancer4 Wrote:

------------------------------------------------------- > With all this new data that is being presented, > along with what we already know about CSX, it > would appear that they are putting themselves in > an excellent position to be merged or taken over. > We will see. While I see where you are coming from, any merger would be met with a lot of opposition I think... Date: 04/25/18 18:45 Re: CSX's graphic on locomotive reductions Author: JLinDE I do not see any mergers on the horizon either. But all RRs are free to sell/lease portions of their RR to short lines or regional, which do a better job of serving customers. That increases RR business over the years, because the volume at the new interchange can increase from a few cars to 50 or more, making it more worthwhile to stop a road freight. CSX and NS are most likely to do this because of the web-like networks in the East and South. If CSX really pushes line sales NS will follow but probably not as aggressively. The two Western and two Canadian carriers have much longer hauls and will do less route shedding. KCS seems to hold its own if Trump does not screw up trade with Mexico. I do not think any RR wants to deal with mergers right now.

|